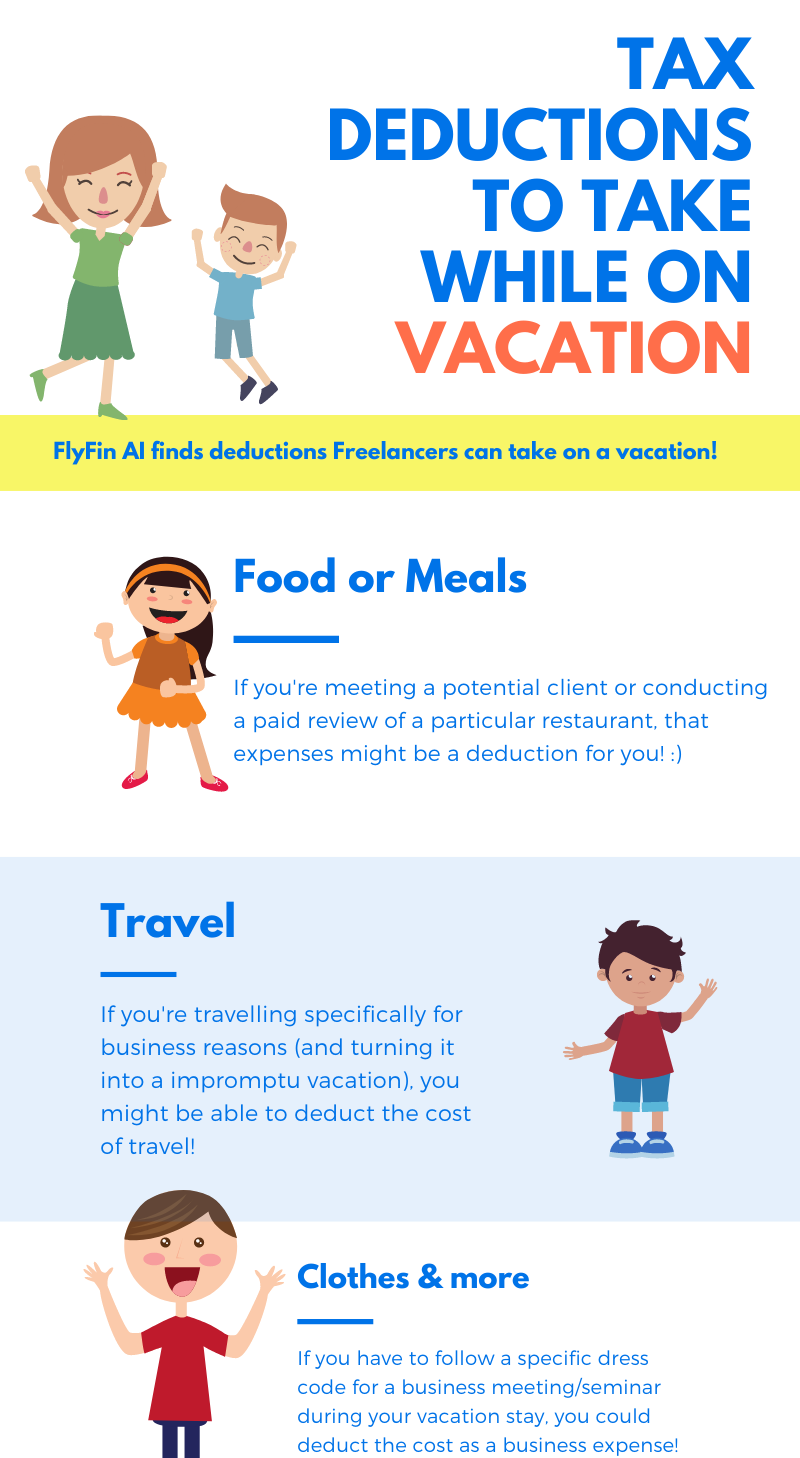

Vacation expenses are generally considered personal in nature but under certain circumstances, it is possible for you to deduct specific expenses while on a vacation.

-

If you’re on vacation and end up meeting a client at some restaurant to discuss your business, you can deduct your meal expenses.

-

If you’re traveling for business reasons, you can deduct the cost of travel.

-

Clothes: Claiming a deduction for clothing is somewhat a grey area unless it’s a proper uniform. So if you have to follow a specific dress code for a business meeting/seminar during vacation, you could deduct the cost as a business expense.

There are many other expenses you can claim while on a vacation. Use FlyFin to find more deductions based on your profession.

(Click on the Image For Full View)