If you’re confused by your PPP loan, you are not alone.

When the first COVID package was passed, not everything was smoothed out.

Accounting for PPP loan turned out to provide a challenge for many small business owners.

When a PPP loan is forgiven, it becomes income to the business. It will need to be booked as income and the business owner will need to pay income taxes on it. If the PPP loan was originally booked as a loan, the liability needs to be reversed.

However, in order to make this reversing entry, business owners must actually verify that the loan has been forgiven. Not all companies have received confirmation that their application has been approved. Therefore, there has been a lot of uncertainty around the appropriate accounting treatment.

Before your taxes are due, we suggest consulting with a professional to assess your situation so you can make any final adjustments.

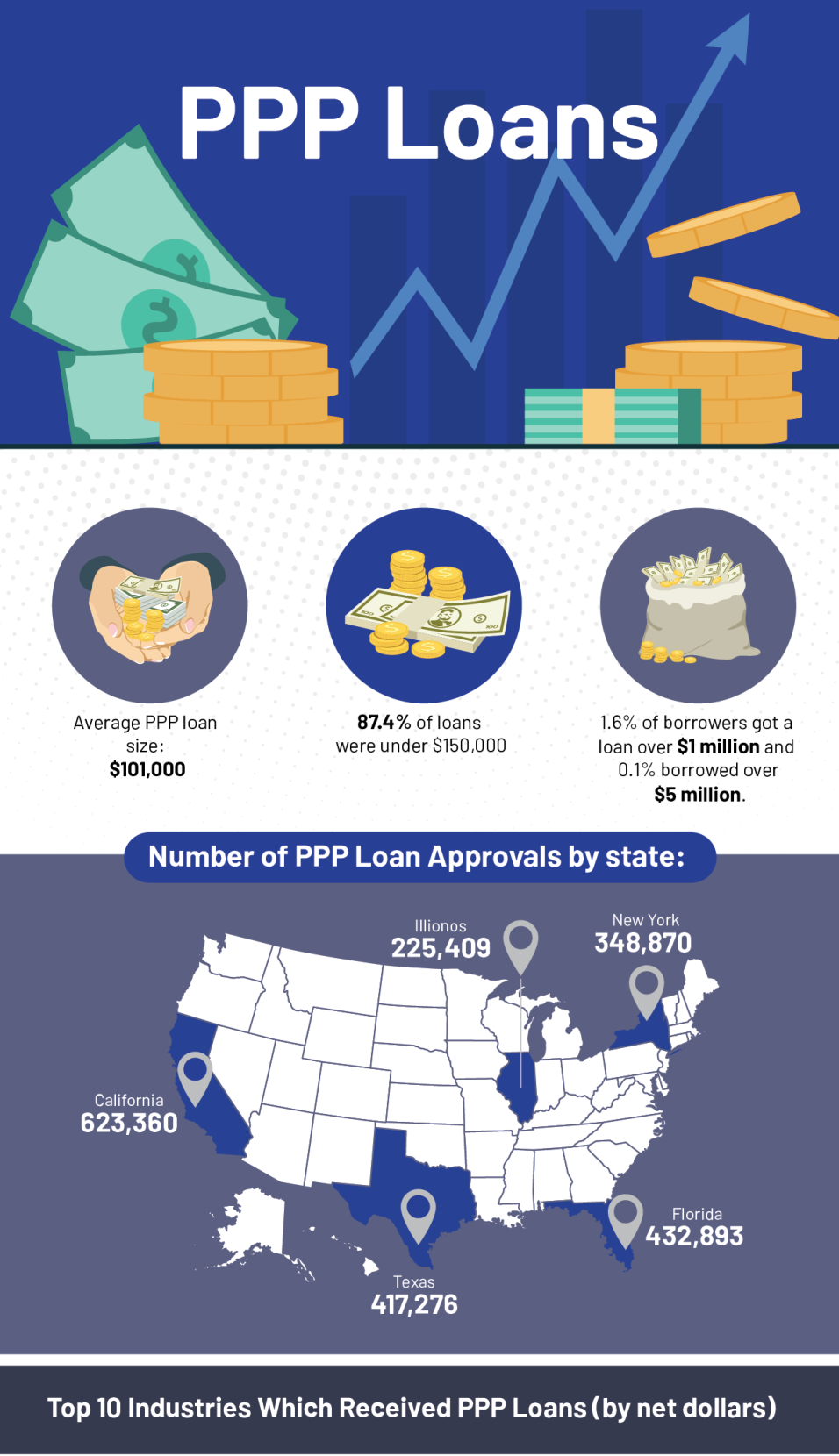

(Click on the Image For Full View)

Source: Small Business Learning